Renters Insurance in and around Owings Mills

Your renters insurance search is over, Owings Mills

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Trying to sift through providers and deductibles on top of family events, work and keeping up with friends, isn’t easy. But your belongings in your rented house may need the incredible coverage that State Farm provides. So when mishaps occur, your clothing, sound equipment and linens have protection.

Your renters insurance search is over, Owings Mills

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

Renters often raise the question: Is renters insurance really necessary? Think for a moment about the cost of replacing your personal property, or even just a few high-cost things. With a State Farm renters policy by your side, you don't have to be afraid of thefts or accidents. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've stored in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Martina Hendon can help you add identity theft coverage with monitoring alerts and providing support.

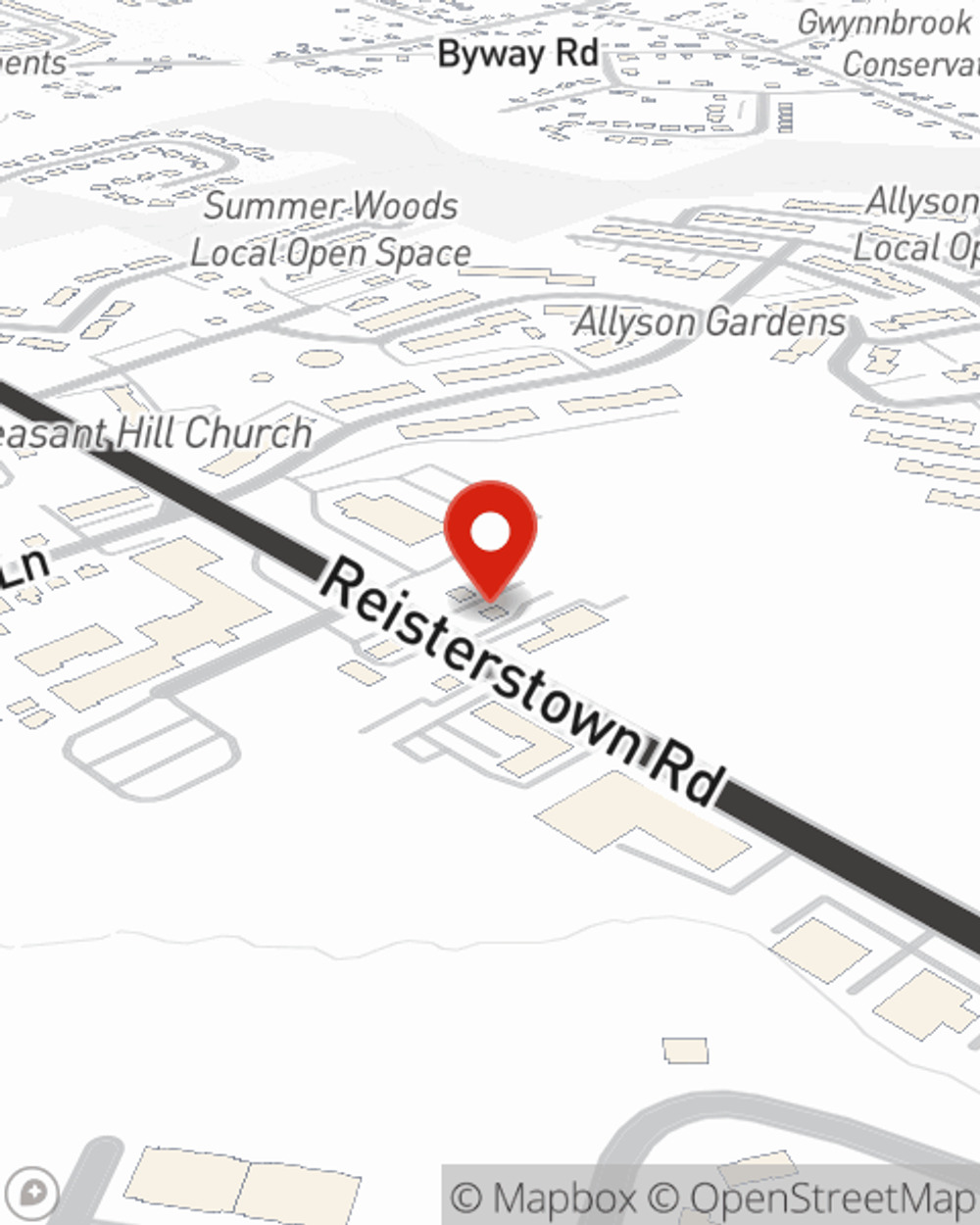

If you're looking for a dependable provider that can help you protect your belongings and save, reach out to State Farm agent Martina Hendon today.

Have More Questions About Renters Insurance?

Call Martina at (410) 744-8333 or visit our FAQ page.

Simple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Martina Hendon

State Farm® Insurance AgentSimple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.